32+ how much can we afford mortgage

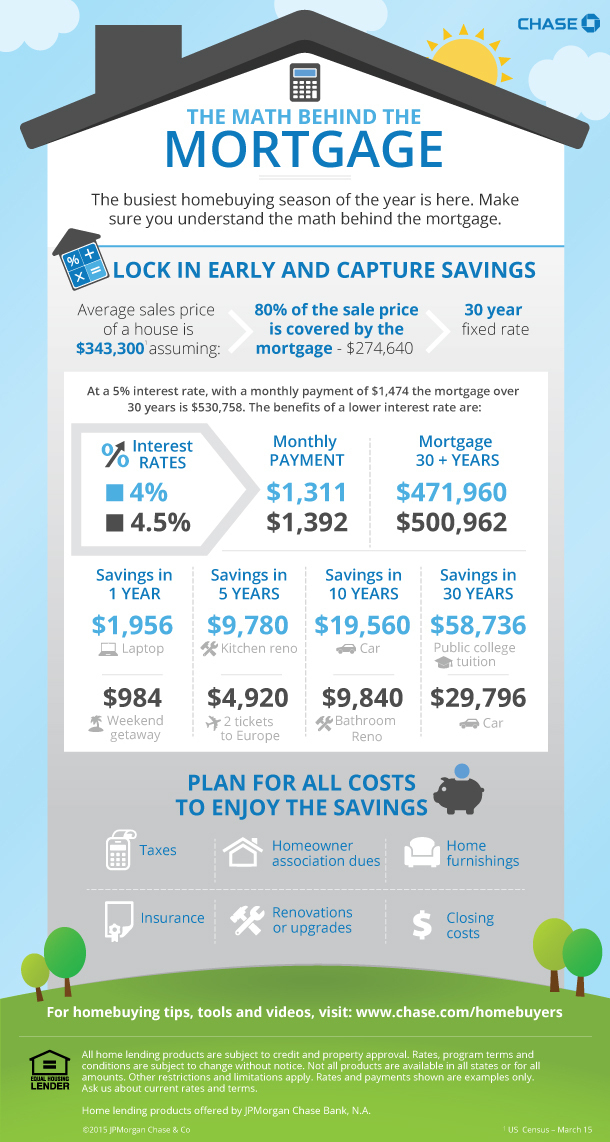

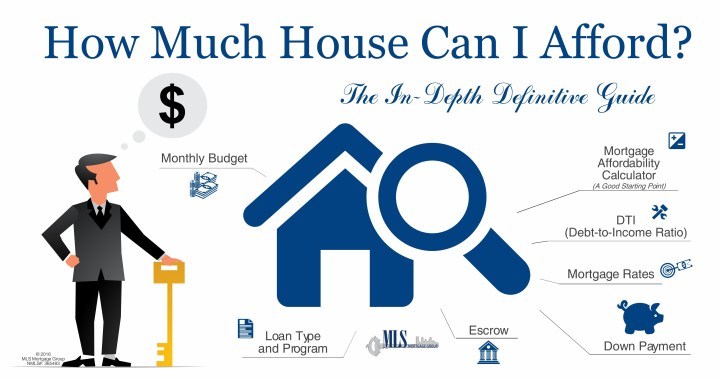

The kind of loan you get for example a 30-year fixed 30-year adjustable 15-year fixed etc. Web Affordability calculator Find an estimate of how much mortgage or rent you can afford.

How Much House Can I Afford

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability.

. Im not sure Show me both options. Web A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Web Use our free mortgage calculator to estimate your monthly mortgage payments.

Ad The Best Way To Find Compare Mortgage Loan Lenders. Take the First Step Towards Your Dream Home See If You Qualify. The maximum home price you could afford would be.

Get an estimated home price and monthly mortgage payment based on your income monthly debt down payment and location. Web Find out how much house you can afford with our mortgage affordability calculator. Once you find the price you can.

For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. Ad First Time Home Buyers. Change any one of these four factors and you may be able to afford a more expensive or less expensive home.

For example some experts say you should spend no more than 2x to 25x your gross annual. You can use the above calculator to estimate how much you can borrow based on your salary. Get answers to some basic home affordability questions.

Web Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. Web Keep in mind that closing costs including any additional taxes and fees can add up. Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well.

Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Keep in mind the calculator just provides a general estimate. How much you can pay monthly.

Backed By Reputable Lenders. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

If youre buying a home thats worth 200000 and you put down 20000 you will have a balance of 180000 on your loan. Rent I like the flexibility of renting. Take the First Step Towards Your Dream Home See If You Qualify.

Generally lend between 3 to 45 times an individuals annual income. Apply Now With Quicken Loans. Save Real Money Today.

Web Use our mortgage calculator and with just a few simple details we can show you how much you could be eligible to borrow as well as breaking down your monthly repayments. Web If your down payment is 25001 or more you can find your maximum purchase price using this formula. Web Follow these steps to use the Forbes Advisor mortgage calculator.

On a 30-year. How much you can pay up front in a down payment. Your LTV ratio would be 90.

Web Thats why we offer this free home affordability calculator. Skip to Main Content. Ad First Time Home Buyers.

Web The home price you can afford depends on four key factors. For example lets say your pre-tax monthly income is 5000. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

You could afford a home that costs up to. Check Your Eligibility for a Low Down Payment FHA Loan. You can find this by multiplying your income by 28 then dividing that by 100.

Buy I want to be a homeowner. Ad Compare Mortgage Options Calculate Payments. Step 1 - Your desired living situation Are you looking to buy or to rent.

Enter the home price. Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. For example lets say you have saved 50000 for your down payment.

Ad Compare Mortgage Options Calculate Payments. 20 of the purchase price. Web 10 for the portion of the purchase price above 500000.

50000 - 25000 10. Web The more you put toward a down payment the lower your LTV ratio will be. Your home or property may be repossessed if you do.

Were Americas Largest Mortgage Lender. Lenders may use the 2836 rule which stipulates that housing expenses should not exceed 28 of your monthly. To get a better sense of how much home you can afford consider getting prequalified or pre-approved for a loan with Freedom Mortgage.

Check Your Eligibility for a Low Down Payment FHA Loan. Keep in mind that if your down payment is less than 20 of the price of your home youll need to purchase mortgage default insurance which can be added to the principal amount of your mortgage. Account for interest rates and break down payments in an easy to use amortization schedule.

Were Americas Largest Mortgage Lender. Web How much can you borrow. Web A general guideline is to spend no more than 30 of your income on housing expenses.

Lock Your Mortgage Rate Today. Web Most home loans require a down payment of at least 3. Our calculator will help you estimate the price of homes that fit within your budget.

Ad Get an idea of your estimated payments or loan possibilities. Ad See how much house you can afford. Web Well help you estimate how much you can afford to spend on a home.

This calculator helps you estimate how much home you can afford. The 15-year fixed mortgage has an average rate of 632 with an APR of 636. Apply Now With Quicken Loans.

Lock Your Mortgage Rate Today. Simply enter your monthly income expenses and expected interest rate to get your estimate. Try our mortgage calculator.

Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. Estimate your monthly mortgage payment. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Consider the 28 rule which states that mortgage payments shouldnt be more than 28 of your pre-tax monthly income. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. 1 million or more.

Since youve already paid 10 youll still owe 90 of the value of the house. Get Terms That Meet Your Needs. Web A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

Get Competitive Rates That Work Within Your Budget. For a 250000 home a down payment of 3 is 7500 and a down. Provide details to calculate your affordability Annual income Total income before taxes for you and your household.

Mortgage lenders in the UK. That might sound exciting at first but with a monthly payment of about 3225 it would eat. Step 2 - Your financial information Step 3 - Your monthly expenses Disclaimer.

If youre not comfortable with nearly a third of your income going toward. Ad Calculate Your Payment with 0 Down. Down Payment Amount - 25000 10.

Contact a mortgage loan officer to learn more about these important pieces of the homebuying journey. Annual income Your yearly household income before taxes. Web Home Affordability Calculator.

Explore what you may afford Question 1 What is your yearly income.

32 Free Financial Assistance Programs For Cancer Patients

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

5157 Garrett Court Calabasas Ca 91302 Zerodown

Mortgage Broker Mackay L Home Loan L Financial Advice Mortgage Choice

![]()

How Much House Can I Afford Calculator Wells Fargo

How Much House Can You Afford

How Much Can I Borrow Calculator Moneysupermarket

How Much Can I Borrow Calculator Moneysupermarket

Mortgage Affordability Calculator What Mortgage Can I Afford

How Much House Can I Afford

30755 Ga Real Estate Homes For Sale Redfin

43902 W Elizabeth Avenue Maricopa Az 85138 Zerodown

How Much House Can I Afford Affordability Calculator Nerdwallet

Mike Meena Associates Home Loans Santa Clarita Ca

How Much House Can I Afford Affordability Calculator Nerdwallet

Moneybrag Blog How Much House Can You Afford

How Much House Can I Afford Affordability Calculator Nerdwallet

Komentar

Posting Komentar